Competing Interests: There are no potential competing interests in our paper and all authors have seen the manuscript and approved it to submit to your journal. We confirm that the content of the manuscript has not been published or submitted for publication elsewhere.

- Altmetric

The sustainable development of pension systems has been investigated from a financial perspective worldwide. However, the pension adequacy and its effect on the sustainability of a national pension system are still understudied. Using actual replacement rate and modified living standards replacement rate, this study empirically evaluates whether China’s New Rural Pension Scheme (NRPS) grants enough livelihood protection for the rural residents in the Northwestern China. The results show that the NRPS fails to meet the basic needs of the elderly people (i.e., age of sixty years or older) or the middle-aged people (forty-five to fifty-nine years old), while it only provides limited protection for the young people (sixteen to forty-four years old). These findings suggest that the current NRPS benefits are very low in the Northwestern China and policy reforms should be further implemented to improve the sustainable development of the New Rural Pension Scheme.

Introduction

The sustainable development of a country’s pension system plays a key role in maintaining social harmony and economic development [1]. Policymakers worldwide have argued that lowering individual expenses on pensions and raising retirement age can effectively enhance the sustainability of pension systems [2, 3]. However, the sustainable development theory emphasizes certain development that not only satisfies the needs of the present, but also not threaten the ability of future generations to meet their own needs [4]. This indicates that some priorities may be given to meeting the needs of the contemporary generation, especially the basic needs of the poor around the world. Accordingly, reducing individual payments on pensions would inevitably lower residents’ pension benefits, and this means that whether they will have sufficient income for their basic needs after retirement is questionable. Nevertheless, pension inadequacy would negatively affect residents’ confidence and enthusiasm for participating in the pension system, thereby hurting its sustainable development. As Hagemejer and Woodall (2014) commented, if people recognize that the pension system cannot guarantee a full and fair life protection that they expect after retirement, the pension reform would fail to achieve the expected goals [5]. Although the literature on the monetary sustainability of pension systems is growing worldwide [6, 7], little attention has been paid to the pension adequacy and its effect on the sustainable development of the pension system [8].

China has the most aged population in the world. According to the most recent census, there were 178 million people aged over sixty in 2010, accounting for 13.3 percent of China’s whole population, and approximately 60 percent of the elderly were living in the rural areas [9]. Considering the speedy boom of the elderly population, organizing a sufficient and financially sustainable pension system is an essential project for the Chinese government [10]. This is because rural poverty remains one of China’s critical social issues and over 43 percent of the rural elderly are still living in poverty [11]. In addition, the traditional Chinese family structure that previously played a key role in caring for the rural elderly people has been greatly weakened due to recent social and economic development [12]. It is, therefore, essential to construct a sustainable rural pension system and ensure the long-term financial security of the modern and future cohorts of rural pensioners in China.

Following a variety of pilot projects in selected rural areas, a national program called the New Rural Pension Scheme (NRPS) was launched in 2009 and it was available across all rural areas in China. Today, almost all rural residents who are sixty years or older are eligible to receive an old age pension. Several studies have evaluated the sustainability of the New Rural Pension Scheme from a financial perspective. For example, Wang and Béland (2014) developed an actuarial model to assess the monetary sustainability of rural pensions in China, and they concluded that the rural pension plan was financially unsustainable. Liu and Sun (2016) noted that although the new rural pension system had been established to cover almost all rural residents in China, the amount of actual financial benefit per person was very low and varied across different regions. Although the financial sustainability of the NRPS has been widely evaluated, to the best of the authors’ knowledge, few research have centered on the pension adequacy and its influence on the sustainability of NRPS.

This research conducts a case study focusing on Gansu Province, northwestern China to assess the pension adequacy of the New Rural Pension Scheme. Gansu is a good representative for the underdeveloped regions of China. Therefore, the evaluation of pension system in Gansu can contribute to the improvement and implementation of China’ national pension system that helps enhance the livelihoods of rural residents, in particular, those in many poor regions. According to a report published by Gansu Provincial Government [13], the number of rural residents participating in the New Rural Pension Scheme in Gansu Province had reached 12.6 million by the end of 2016, that is, an 87 per cent coverage of rural residents in the province. However, it still remains an open question whether the current pension system meets residents’ needs in rural areas such as Gansu. By assessing the pension adequacy of NRPS, this study aims to provide insights for the sustainable development of rural pension systems in China, as well as in many developing countries.

The rural pension system in China

In rural China, due to the prevalence of the traditional idea that people should raise children in preparation for their old age, caring for the elderly people was a family matter prior to the middle of the 20th century [14]. However, this traditional notion has changed dramatically since then owing to the country’s significant social and economic transformation, thereby the Chinese government began to play a major role in old age protection in rural China [15]. By the end of the 1990s, the Chinese authorities had initiated several pilot projects aimed at creating an old age insurance program in rural areas (also called the Old Rural Pension Scheme, ORPS). It has been argued that due to lack of trust in non-public pension plans, only about 54 million rural residents had participated in the ORPS by 2004, resulting in a failure of the pilot program [15]. Along with the new administration in the Chinese central government in 2002, the role of social protection, social welfare, and improvement in the well-being of socially vulnerable rural residents once more came to the fore [16]. Over the next few years, the Chinese government initiated several pilot programs once again based on the experience of ORPS. In 2009, a new rural pension plan called the New Rural Pension Scheme was set up for all rural residents.

The NRPS consists of a non-contributory basic social pension (SP) component and a funded defined contribution (FDC) component [14]. The basic pension is available to people who have reached the age of sixty. Those who had already reached this age when the NRPS was initially implemented were eligible to receive the basic pension even if they had never contributed to the scheme, provided that their adult children “voluntarily” enrolled in and contributed to the FDC component. The FDC component is an aggregate of the personal contributions and the subsidies provided by central and local governments. Those younger than sixty become eligible for the basic pension and an individual pension amount after having contributed to the FDC for at least fifteen years and having reached age sixty. There are a variety of alternative contribution levels, ranging from ¥100 to ¥500 per year [17]. If one contributes more to the FDC each year, she/he can get more pension benefits when reaching age sixty. In 2014, the central government decided to merge the NRPS and the Urban Residents Pension Plan and build a unified basic pension insurance plan for both urban and rural residents. In addition, on the basis of residents’ previous contribution levels, several other contribution choices (¥600, ¥700, ¥800, ¥900, ¥1,000, ¥1,500 and ¥2,000 per year) were made available [18]. Table 1 presents a brief overview of China’s rural pension reforms.

| Year | Pension scheme | Pension amount (¥/month) | Number of participants (million RMB) | Nature of participation | Source |

|---|---|---|---|---|---|

| 1999 | Old Rural Pension Scheme (ORPS) | 2–20 | 80 | Voluntary | Liu and Sun (2016) [15] |

| 2009 | New Rural Pension Scheme (NRPS) | 55–593 | 90 | Voluntary | Deng and Xue (2010) [19] |

| 2014 | A combination of NRPS and Urban Residents Pension Plan | 84–2800 | 498 | Voluntary | Huang (2015) [20] |

Notes: ¥6.8 (RMB) = $1 (USD).

Gansu Province and the New Rural Pension Scheme

Gansu Province is located in the northwest of China and composed of fourteen prefectures. The land area of Gansu Province is 42.6×104 square kilometres, covering approximately 4.7 per cent of the total area of China. The total population of Gansu was 26.1 million in 2018, with 55.3 per cent living in rural areas [21]. In 2009, the population of the elderly people aged over sixty was 3.18 million in Gansu, accounting for 12.4 per cent of the province’s total population [22]. Gansu Province is one of China’s least developed regions, with relatively poor agricultural production conditions and a low level of urbanisation. The per capita disposable income of rural residents in Gansu was about ¥8,804 in 2018, much lower than the national average (¥14,617) [21].

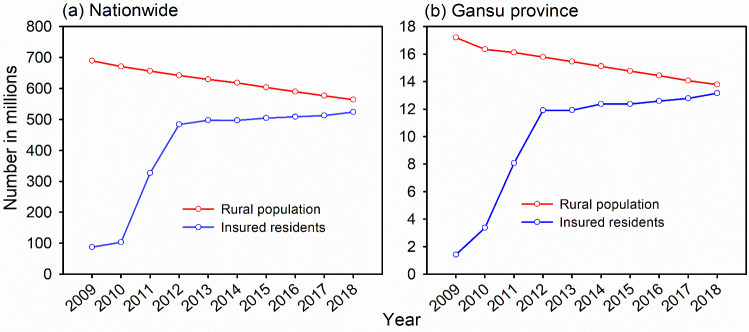

The New Rural Pension Scheme provides pensions for millions of rural residents and represents a major step forward for the rural pension reform in China. Fig 1 shows the changes in the rural population and insured rural residents in Gansu Province and the whole country from 2009 to 2018. Since the implementation of NRPS in 2009, there has been a rapid increase in coverage over the past seven years. In Gansu Province, about 13.2 million (96 per cent) of rural residents were covered by the end of 2018 (Fig 1). This includes 3.2 million residents over the age of sixty–almost the entire rural retirement-age population in Gansu Province [21].

Trends in rural population and coverage of NRPS in China (a) and Gansu Province (b). Data source: China Statistical Yearbook.

Methods

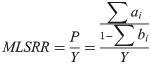

To determine whether the elderly in retirement can maintain their basic living needs, the typical approach is to compare an actual replacement rate (ARR) with a benchmark replacement rate. The most commonly used benchmark is the living standards replacement rate (LSRR) [23]. The actual replacement rate is defined as the ratio of a person’s income after retirement to that before retirement [24]. The living standards replacement rate aims to capture the continuity of a person’s living standards after retirement by comparing the amount of money she/he needs to support personal consumption of goods and services before and after retirement [25]. Considering almost all the pension benefits are used to meet residents’ basic living needs in China’s poor regions [25], this study utilizes a modified living standards replacement rate (hereafter referred to as MLSRR) that removes the excess demand for commodities. By comparing the ARR and MLSRR, this study assesses the pension adequacy of China’s NRPS in the poor areas.

Residents’ payment to the FDC component varies with their ages. In order to improve the accuracy of the current forecast, the insured residents were divided into three groups: elderly people, referring to residents aged sixty or over and who were eligible for the basic pension in 2014 when the NRPS and the Urban Residents Pension Plan were merged; middle aged people, referring to residents under sixty years old and who need to pay the FDC component for a further one to fifteen years; and young people, referring to residents who still have to contribute for at least sixteen more years prior to receiving any pension benefits.

Actual replacement rate

This study follows Wang & Béland (2014) to build the actuarial model. The model is based on several assumptions: (1) the New Rural Pension Scheme policy framework will remain stable until 2058; (2) both central government and Gansu provincial government subsidies are collectively referred to as government subsidies; (3) according to the People’s Republic of China Social Insurance Law, the central government will adjust the basic pension and funded defined contribution subsidies based on the growth of residents’ income and inflation level; (4) because multiple payment were added in 2014 when the NRPS and the Urban Residents Pension Plan were merged, 2014 was set as the baseline year; (5) at the beginning of each year, the insured residents routinely pay the FDC component and the payment level they have selected remains stable for all years thereafter; (6) for the elderly people, all their adult children have participated in the NRPS and they can thus receive the basic pension amount.

Actual replacement rate (ARR) actuarial model

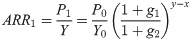

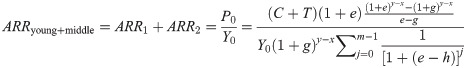

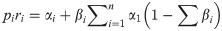

Considering that the elderly people only have access to the SP component, the ARR values of the elderly, middle aged and young people are calculated separately. The ARR of the basic pension of the elderly people is ARRelderly, expressed as:

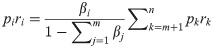

The pension income for the middle aged and young people after they retire consists of the basic SP pension and their personal FDC pension. Therefore, their ARR includes two parts, i.e., ARR1 for the basic pension and ARR2 for the personal pension. The ARR1 can be expressed as:

According to the third assumption above, the adjustment of the basic pension coincides with the growth of rural residents’ per capita net income, and thus the two parameters g1 and g2 are considered to be equal (replaced by g). Therefore, the Eq (2) can be further expressed as:

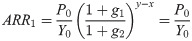

The ARR for the middle aged and young people is denoted by ARRyoung+middle, expressed as:

Parameters of the ARR actuarial model

According to The Guidance for Carrying Out the NRPS and the People’s Republic of China Social Insurance Law, this study utilizes the following parameters in the ARR actuarial model (Table 2):

Interest rate of personal account (e). The interest rate for personal accounts is equal to China’s annual bank interest rate on deposits [21]. This study uses an average interest rate from 2008 to 2019, and e ≈ 3 percent.

Inflation rate (h). According to the announcement issued by the People’s Bank of China, the inflation rate is expected to be maintained at about 2 percent over following years [21]. Thus, the inflation rate is set at h = 2 percent.

Growth rate of per capita net income of rural residents (g). According to the statistics of the net income of rural residents in Gansu Province from 2008 to 2019 [21], this model uses the growth rate at g ≈ 6 percent.

Mean number of years for which rural residents can enjoy the pension benefits (m). According to The Guidance for Carrying Out the NRPS, the average number of years is calculate and equal to 11.58 years (i.e., 139 divided by 12) [26]. Thus, the model parameter m = 12.

Government subsidies (T). If the insured residents pay ¥100-¥400 for FDC each year, the central government will subsidise them with ¥30 per year; if they pay ¥500 or more, they will obtain ¥60 from the government per year [13]. Thus, T is equal to ¥30 (resident payment ¥100-¥400) or ¥60 (resident payment ≥ ¥500).

Basic pension (P0). The central and provincial governments provide ¥88 and ¥15 per month, respectively, for each insured resident [13]. Thus, the basic pension amount, P0, is equal to ¥1,236 per year.

Per capita net income (Y0). According to the China Statistical Yearbook, the per capita net income of rural residents is calculated at Y0 = ¥5,107.76 (EBGDY, 2019).

| Parameters | h (%) | e (%) | g (%) | m (years) | P0 (¥) | Y0 (¥) | ARRelderly (%) | T (¥/year) | |

|---|---|---|---|---|---|---|---|---|---|

| Payment of 100–400 | Payment of 500 or more | ||||||||

| Value | 2 | 3 | 6 | 12 | 1236 | 5107.76 | 24.2 | 30 | 60 |

Notes: h, inflation rate; e, interest rate of personal account; g, growth rate of per capita net income; m, the mean time period to receive pension benefits; P0, the basic pension amount in 2014; Y0, the per capita net income of rural residents in 2014; T, annual subsidy per person.

¥6.8 (RMB) = $1 (USD).

Extended linear expenditure system model

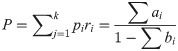

To calculate the MLSRR, we first predict rural residents’ basic living expenses in the studied time period. We employ an extended linear expenditure system (ELES) model to measure the basic living expenses and then calculate the MLSRR by dividing the predicted basic living expenses by the per capita net income.

The linear expenditure system (LES) is developed to examine the demand relationships of various commodities, and the extended linear expenditure system (ELES) has two modifications based on the LES model. First, the total consumption expenditure is substituted by income to obtain exogenous variables, through which the consumption-saving decisions are also included in the model. Second, the marginal budget is replaced with marginal propensity to consume. The ELES model divides people’s needs for various commodities into two parts: basic demand and demand beyond the basic demand. This study considers the protection purpose of NPRS in the poor regions, and thus the demand for commodities by rural residents refers to the basic demand. In addition, the ELES model adds three assumptions:

In a fixed period of time, residents’ demand for various commodities depends on their income and commodity prices;

The basic demand is not associated to the resident income;

The marginal budget is not related to the consumption.

According to Gansu’s Development Yearbook, the rural residents’ living expenditure can be categorized into eight types: food, clothing, residence, household facilities, transport and communication, cultural and recreation education services, health care and medical services, as well as miscellaneous goods and services. According to the ELES, the total consumption of goods consists of two parts: the basic demand for daily necessities and the extra demand [27]. The basic demand for daily necessities is independent on residents’ income. Because almost all of the pension benefits are used to meet the elderly person’s basic needs in China’s poor regions [18], the modified living standards replacement rate (MLSRR) is adopted in this research, which removes the extra demands for commodities.

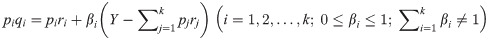

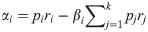

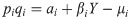

The basic expression of the ELES model can be expressed as:

Since the price (pi) and the actual demand (qi) of the ith good consist of household-level data that are not available, the following equation is derived:

We can substitute Eqs (7) into (6) and obtain:

| Year | Parameters | Food | Clothing | Residence | Household facilities, articles and services | Transport and communications | Education, cultural, recreation and services | Health care and medical services | Miscellaneous goods and services |

|---|---|---|---|---|---|---|---|---|---|

| 2007 | ai’ | 551.053* | 32.467** | 37.036 | -14.67 | 19.024 | 1.39 | 6.489 | -0.848 |

| bi’ | 0.169* | 0.034* | 0.111* | 0.045** | 0.072* | 0.089** | 0.062** | 0.013** | |

| R2 | 0.996 | 0.997 | 0.994 | 0.968 | 0.994 | 0.975 | 0.976 | 0.982 | |

| 2008 | ai’ | 674.590* | 51.14** | 39.279 | -2.857 | 57.178*** | -2.315 | 13.969 | 2.02 |

| bi’ | 0.168* | 0.031* | 0.128** | 0.036** | 0.065* | 0.082** | 0.055* | 0.011** | |

| R2 | 0.998 | 0.995 | 0.968 | 0.968 | 0.993 | 0.985 | 0.99 | 0.969 | |

| 2009 | ai’ | 710.914* | 48.728** | 87.626 | 11.42 | 51.431*** | 6.118 | 24.364*** | -3.079 |

| bi’ | 0.145* | 0.036* | 0.188** | 0.044** | 0.063** | 0.071* | 0.052* | 0.015** | |

| R2 | 0.997 | 0.99 | 0.965 | 0.930 | 0.988 | 0.991 | 0.997 | 0.988 | |

| 2010 | ai’ | 837.453* | 74.013** | -16.25 | 34.690*** | 32.484 | 7.451 | 20.984 | -0.154 |

| bi’ | 0.140* | 0.032* | 0.165* | 0.033* | 0.066* | 0.067* | 0.053* | 0.013* | |

| R2 | 0.989 | 0.985 | 0.959 | 0.982 | 0.98 | 0.996 | 0.971 | 0.982 | |

| 2011 | ai’ | 949.97* | 104.697** | 288.834** | 74.226** | 72.657 | -15.035 | 147.358*** | -2.551 |

| bi’ | 0.153* | 0.036** | 0.079* | 0.032** | 0.075* | 0.079* | 0.049** | 0.020* | |

| R2 | 0.994 | 0.976 | 0.987 | 0.988 | 0.981 | 0.987 | 0.967 | 0.992 | |

| 2012 | ai’ | 949.763* | 90.267* | 248.309*** | 79.843*** | 117.542 | -13.117 | 136.217** | 0.356 |

| bi’ | 0.155* | 0.047* | 0.097** | 0.038* | 0.071** | 0.075* | 0.058** | 0.022** | |

| R2 | 0.996 | 0.998 | 0.929 | 0.984 | 0.944 | 0.994 | 0.988 | 0.986 | |

| 2013 | ai’ | 1272.285* | 218.382* | 519.219*** | 184.557* | 218.015*** | 86.639 | 361.014** | 60.845** |

| bi’ | 0.103* | 0.026** | 0.054*** | 0.023** | 0.074** | 0.055** | 0.03*** | 0.012** | |

| R2 | 0.994 | 0.986 | 0.814 | 0.985 | 0.959 | 0.978 | 0.86 | 0.973 | |

| 2014 | ai’ | 1330.351* | 249.725* | 561.770** | 195.390** | 315.585** | 145.689 | 277.706** | 68.699*** |

| bi’ | 0.109** | 0.023* | 0.054** | 0.021*** | 0.052** | 0.045** | 0.040** | 0.009*** | |

| R2 | 0.969 | 0.999 | 0.817 | 0.909 | 0.976 | 0.934 | 0.935 | 0.808 | |

| 2015 | ai’ | 1507.663* | 298.211** | 658.824** | 297.940** | 463.603** | 537.605** | 235.055*** | 73.523** |

| bi’ | 0.106** | 0.024** | 0.081** | 0.021*** | 0.050** | 0.046** | 0.063** | 0.006** | |

| R2 | 0.985 | 0.978 | 0.944 | 0.919 | 0.923 | 0.969 | 0.953 | 0.969 | |

| 2016 | ai’ | 1328.069* | 296.870** | 847.919** | 282.554** | 541.695** | 725.582* | 222.408*** | 49.258*** |

| bi’ | 0.057** | 0.025** | 0.064** | 0.024** | 0.055** | 0.032** | 0.080* | 0.010* | |

| R2 | 0.976 | 0.978 | 0.962 | 0.956 | 0.927 | 0.959 | 0.977 | 0.959 | |

| 2017 | ai’ | 1693.24** | 324.852* | 706.294 | 311.555** | 433.49** | 775.637** | 297.624** | 64.376*** |

| bi’ | 0.092** | 0.023* | 0.063 | 0.021** | 0.072** | 0.027*** | 0.073* | 0.009** | |

| R2 | 0.964 | 0.992 | 0.282 | 0.971 | 0.984 | 0.805 | 0.992 | 0.961 | |

| 2018 | ai’ | 1918.35* | 440.103** | 1416.661** | 383.792** | 751.025** | 1046.761** | 748.089** | 65.3*** |

| bi’ | 0.088** | 0.013*** | 0.035*** | 0.015 | 0.037** | 0.018 | 0.044** | 0.011** | |

| R2 | 0.983 | 0.876 | 0.818 | 0.768 | 0.961 | 0.670 | 0.959 | 0.951 |

Note: ***p < 0.05,

**p < 0.01,

* p < 0.001. ai’ and bi’ are the fitted values of ai and bi.

Data and analytical procedures

The data related to rural residents’ net income and their expenditure were obtained from the Gansu Development Yearbook [13, 28]. The data on rural population and NRPS coverage were drawn from the China Statistical Yearbook [21]. In addition, the data about rural residents’ income and consumption in Gansu Province were from the Editorial Board of Gansu Development Yearbook from 2007 to 2019 (http://www.gstj.gov.cn). The data about macroeconomic indicators were from the People’s Bank of China (http://www.pbc.gov.cn/).

All the statistical analyses were conducted using Stata Version 14.0. First, the actuarial model of the NRPS was constructed using the actuarial principle, and subsequently the actual replacement rate (ARR) was measured and predicted. Second, the extended linear expenditure system (ELES) model and the OLS method were used to measure rural residents’ expenditure on the basic consumption of items falling into the eight categories between 2008 and 2019. Then, the linear fitting was used to calculate the rural residents’ basic expenditure and per capita disposable income between 2020 and 2058. Finally, the modified living standards replacement rate (MESRR) was calculated.

Results

Actual replacement rate

As a benchmark, the actual replacement rate of the elderly people’s basic pension, ARRelderly, is found to be 24.2 percent. Table 4 presents the results of the ARR actuarial model for middle aged and young people. The actual replacement rate increases as the individuals’ FDC payment level increases. Similarly, at each payment level, the ARRyoung+middle increases as the length of payment increases (i.e., the younger the resident starts to enroll in the program). For example, at the contribution level of ¥100, the ARR increases from 24.4 for a resident starting enrolment at 59 years old to 29.2 starting at 16 years old. Especially, at the high payment levels (e.g., ¥1,500 and ¥2,000), the ARR increases dramatically as the insured age decreases.

| Age insured | Year eligible to receiving pension benefits | Contribution levels (¥) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 100 | 200 | 300 | 400 | 500 | 600 | 700 | 800 | 900 | 1000 | 1500 | 2000 | ||

| 16 | 2058 | 29.2 | 33.1 | 36.9 | 40.8 | 45.8 | 49.7 | 53.5 | 57.4 | 61.3 | 65.1 | 84.4 | 103.7 |

| 19 | 2055 | 29.0 | 32.8 | 36.5 | 40.2 | 45.1 | 48.8 | 52.5 | 56.2 | 59.9 | 63.7 | 82.3 | 100.9 |

| 24 | 2050 | 28.7 | 32.0 | 35.6 | 39.1 | 43.6 | 47.1 | 50.6 | 54.0 | 57.5 | 61.0 | 78.3 | 95.6 |

| 29 | 2045 | 28.3 | 31.5 | 34.7 | 37.8 | 42.0 | 45.1 | 48.3 | 51.4 | 54.7 | 57.8 | 73.7 | 89.5 |

| 34 | 2040 | 27.9 | 30.7 | 33.5 | 36.4 | 40.1 | 42.9 | 45.7 | 48.5 | 51.4 | 54.2 | 68.4 | 82.5 |

| 39 | 2035 | 27.4 | 29.8 | 32.2 | 34.5 | 37.8 | 40.1 | 42.7 | 45.2 | 47.6 | 50.0 | 62.2 | 74.4 |

| 41 | 2033 | 27.1 | 29.4 | 31.7 | 33.9 | 36.9 | 39.1 | 41.2 | 43.7 | 45.9 | 48.2 | 59.5 | 70.8 |

| 44 | 2030 | 26.8 | 28.8 | 30.7 | 32.7 | 35.3 | 37.3 | 39.3 | 41.2 | 43.2 | 45.2 | 55.1 | 65.0 |

| 49 | 2025 | 26.1 | 27.6 | 29.0 | 30.1 | 32.3 | 33.8 | 35.3 | 36.7 | 38.2 | 39.7 | 46.9 | 54.2 |

| 54 | 2020 | 25.3 | 26.2 | 27.0 | 27.9 | 29.0 | 29.8 | 30.4 | 31.3 | 32.4 | 33.2 | 37.5 | 41.7 |

| 59 | 2015 | 24.4 | 24.6 | 24.7 | 24.9 | 25.1 | 25.2 | 25.4 | 25.5 | 25.7 | 25.8 | 26.6 | 27.3 |

Notes: the baseline year is 2014.

Modified living standards replacement rate

Table 5 presents the estimated basic consumption and modified living standards replacement rate (MLSRR) of the elderly. The MLSRR of the retired residents in 2017 and 2018 is 92.0 percent and 88.2 percent, respectively. Because that the per capita net income is not available for 2019 and after, the MLSRR is forecast from 2019 to 2058 (Table 6). The model forecast indicates that the MLSRR will experience a hump-shaped trend from 2019 to 2058. Specifically, from 2019 to 2023, the MLSRR shows a slight increasing trend and gets the peak at 102.1 percent in 2023. Subsequently, the MLSRR experiences a downward trend and stands at 40.6 percent in 2058.

| Year | ∑αi | 1-∑βi | piri (¥) | Y (¥) | MLSRR (%) |

|---|---|---|---|---|---|

| 2007 | 631.9 | 0.41 | 1560.3 | 2328.9 | 67.0 |

| 2008 | 833.0 | 0.42 | 1964.6 | 2723.8 | 72.1 |

| 2009 | 937.5 | 0.39 | 2428.8 | 2980.1 | 81.5 |

| 2010 | 990.7 | 0.43 | 2298.5 | 3424.7 | 67.1 |

| 2011 | 1620.2 | 0.48 | 3396.6 | 3909.4 | 86.9 |

| 2012 | 1609.2 | 0.44 | 3682.3 | 4506.7 | 81.7 |

| 2013 | 2920.9 | 0.62 | 4688.5 | 5107.8 | 91.8 |

| 2014 | 3144.9 | 0.65 | 4860.8 | 5736.0 | 84.7 |

| 2015 | 4072.4 | 0.60 | 6753.6 | 6936.0 | 97.4 |

| 2016 | 4294.4 | 0.65 | 6576.3 | 7457.0 | 88.2 |

| 2017 | 4607.1 | 0.62 | 7430.8 | 8076.0 | 92.0 |

| 2018 | 5470.1 | 0.76 | 7159.8 | 8804.0 | 81.3 |

Notes: ∑αi: sum of αi’ estimates of the eight commodities; ∑βi: sum of βi’ estimates of the eight commodities; piri: total basic expenditure of the eight commodity categories; Y: per capita net income.

| Year | MLSRR(%) | Year | MLSRR(%) | Year | MLSRR(%) |

|---|---|---|---|---|---|

| 2019 | 98.6 | 2033 | 90.6 | 2047 | 60.8 |

| 2020 | 100.2 | 2034 | 88.6 | 2048 | 58.8 |

| 2021 | 101.2 | 2035 | 86.6 | 2049 | 56.8 |

| 2022 | 101.9 | 2036 | 84.5 | 2050 | 54.8 |

| 2023 | 102.1 | 2037 | 82.4 | 2051 | 52.9 |

| 2024 | 102.0 | 2038 | 80.2 | 2052 | 51.0 |

| 2025 | 101.6 | 2039 | 78.0 | 2053 | 49.2 |

| 2026 | 100.9 | 2040 | 75.8 | 2054 | 47.4 |

| 2027 | 99.9 | 2041 | 73.7 | 2055 | 45.6 |

| 2028 | 98.7 | 2042 | 71.5 | 2056 | 43.9 |

| 2029 | 97.4 | 2043 | 69.3 | 2057 | 42.2 |

| 2030 | 95.9 | 2044 | 67.1 | 2058 | 40.6 |

| 2031 | 94.2 | 2045 | 65.0 | ||

| 2032 | 92.4 | 2046 | 62.9 |

Comparison of the ARR and MLSRR

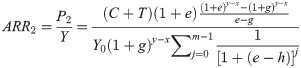

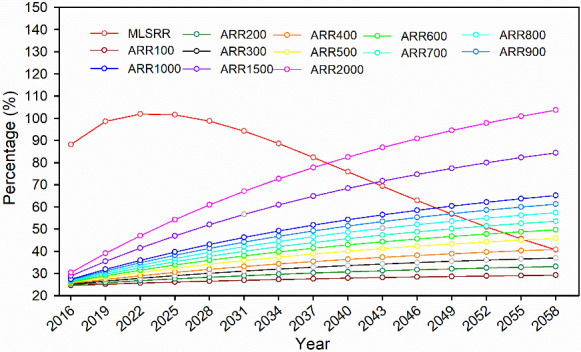

The actual replacement rate (ARR) for the elderly people is 24.2 percent in 2014, which is far lower than the modified living standards replacement rate (MLSRR) (84.7 percent) (Table 5). For the middle aged people, no matter which payment level they choose, the NRPS will not meet their basic living needs when they reach the retirement age (Fig 2). For example, even if a person aged 45 chooses the highest payment level (¥2,000 per year) and contributes to the FDC for fifteen years, the predicted ARR (63.0 percent) in 2029 would still be much lower than the predicted MLSRR (97.4 percent).

Comparison of actual replacement rate (ARR) and modified living standards replacement rate (MLSRR) of the insured residents aged below 60 (the middle aged and young people) when they join the New Rural Pension Scheme.

The ARR100, ARR200,…, and ARR2000 indicate the predicted ARR when selecting the payment levels of ¥100, ¥200, …, and ¥2,000 per year.

Regarding the young people, the results show their basic needs after retirement can be achieved at certain payment levels. The lowest level of FDC payments is ¥400 per year. At this payment level, the ARR in 2058 will be 40.8 percent, slightly higher than 40.6 percent of the MLSRR (Fig 2). This means that a 16 years old person would need to continuously contribute to the FDC for 44 years. If a young person chooses the highest payment level (i.e., ¥2,000 per year), she/he needs to contribute to the FDC for at least 24 years in order to meet the basic needs after retirement (Fig 2).

Discussion

Considerable research efforts worldwide on the diverse national pension systems have focused on their sustainable development [29]. This empirical study adds to the current scholarship and demonstrates that China’s New Rural Pension Scheme cannot meet the basic daily needs of elderly people who are already in retirement, nor those of the middle aged people who have to make payment to the FDC component for one to fifteen years before they can receive pension benefits. For the young people, that the results show the NRPS only provides very limited social security after either contributing to the FDC for at least forty-four years (at ¥400 per year), or contributing for 15 years at the highest contribution level (¥2,000 per year). Our findings are in agreement with previous studies performed in central and eastern China that also found that the NRPS can only provide limited protection for the elderly people [30, 31]. Based on those previous studies and our findings, it is strongly suggested that the pension benefits of the current NRPS are improved to meet the daily living needs of the retired people.

One key implication is that the higher the contribution level selected and/or the longer time period contributed to the FDC component, the higher the pension benefits for the rural residents when they reach the retirement age. However, unfortunately, currently most rural residents just select the lowest contribution level, i.e., ¥100 per year, probably due to lack of understanding of the NRPS. Many scholars and policymakers have suggested that postponing the retirement age facilitates a contribution increase for the FDC component. Thus, postponing the retirement age is currently implemented in China and it can be one of the most effective ways to achieve the sustainability of a pension system [6, 8]. However, this option cannot solve financial distress in the long run, given that the government’s transition pension debt will double in the peak period if the retirement age is postponed for five years, which further poses a risk to the fund liquidity. Unless some major strategies are adopted, the adequacy issue will become even more problematic in the decades to come as the commodity prices increase.

Increasing the basic pension and government subsidies

China is currently spending only about 0.11 percent of its GDP on the SP component [21]. This is substantially lower than the average of 0.42 percent in some Latin American countries which have a similar level of economic development to China [14]. In addition, the Chinese government’s subsidies to the FDC component are also very limited and they only provide 8 percent to match the rural residents’ contribution payment [21]. By contrast, in most OECD countries with a similar FDC scheme, the matching proportion is around 20 percent on average [14]. Chinese people have the traditional culture and preference of saving money in banks, which is much stronger than that in the Latin America and Caribbean countries [32]. If the Chinese government matchs a substantially larger portion of the voluntary FDC contributions, it is likely that the rural residents would invest more of their savings in the NRPS and this also helps shift to higher voluntary contribution levels. In this context, the Chinese government–including central, provincial and local governments–should increase the basic pension and its matching proportions across the country, especially in the poor western regions, to address the concerns on pension adequacy.

Shifting from voluntary FDC to modest mandatory pillar

China’s NRPS has been very successful in promoting rural coverage over the past years. This is mainly attributed to the “family-binding” policy, whereby it is only after their adult children’s “voluntarily” participation in the FDC component that the elderly who are already in retirement age (60 years or older) can receive the basic pension benefits. However, the “voluntary” participation may decline when new retirement-aged rural residents become eligible for the NRPS pension benefits.

Moreover, most rural residents currently opt for the lowest level (¥100) of annual contribution to the FDC component, which results in very low pension benefits that they can receive after retirement. Even if the interest earned on their contributions to the FDC exceeds the inflation rate, the pension benefits generated through the FDC accounts cannot meet the pension needs of the rural population [14]. Considering a possible decrease in future enrolments and low levels of pension benefits, it is suggested that the current voluntary FDC element should shift to a modest mandatory FDC pillar with at least ¥400 per year, that is, the lowest contribution level necessary to meet basic needs after contributing to the FDC for 44 years. This reform option could arguably facilitate the retention of the currently high rural pension coverage and an increase in pension benefits for the rural residents.

Exploring and enhancing other support for retired residents

The comparative evaluation shows that the pension benefits of current NRPS cannot meet the basic needs of the elderly and middle aged people living in rural areas. However, the living expenses of the rural elderly people are not just met with the state-organized pensions. The diversified funding sources for the elderly people in rural China include individual savings, family financial support (also called Confucian welfare familism), intergenerational monetary transfer, formal or informal employment after retirement, and access to farmland. Therefore, these alternative ways facilitate an increase in the social security of those rural residents.

First, the traditional role of family support in caring for the elderly should not be ignored. In recent years, China’s rural population has declined substantially due to the migration of young people looking for better job opportunities. This outmigration has resulted in a decrease in family bonds and disintegrated the traditional family structure, to some extent, endangering the traditional role of family support in senior care. Therefore, the Chinese government should adopt certain strategies (e.g., creating more employment opportunities in rural areas) to support the young population, which helps strengthen the link between the elderly and their adult children.

Second, increasing the return rate of the rural pension fund can be another way to improve the pension adequacy of the NRPS. Currently, China’s social pension fund calculates earnings based on a fixed interest rate for deposits, i.e., an annual rate of 3 percent, which is lower than of the average annual rate of 8 percent in other countries [33]. The Chinese government can, therefore, expand the scope for financial investment of the pension fund. A higher return rate is possible if investing in local government bonds, equity investments, trust loan investments and interbank deposit certificates [34]. Third, commercial pension insurance companies can be encouraged to enter the rural market in western China to diversify the rural pension insurance plans. This will make the commercial pension programs more widely available in rural areas and achieve their complementary but equally important role in supporting the rural residents.

Conclusions

Previous studies on pension systems have focused on reducing future pension expenditures which improves the sustainability of pension systems. This is a rather narrow interpretation of the sustainable development theory of pensions. If the pension adequacy is not guaranteed, a huge negative impact can be expected to influence the sustainable development of pension systems. In this regards, this study evaluates the sustainability of pension systems from the perspective of ensuring pension adequacy in poor rural areas. Drawing on the actuarial model and the extended linear expenditure system model, this paper investigates the adequacy of rural pensions in western China and focuses on a case study of Gansu Province using data from multiple national and provincial sources.

The results show that pensions under the current New Rural Pension Scheme cannot meet the basic needs of the elderly and middle aged people, as well as most young people in western China. Our findings confirms that from previous pension studies in eastern and central China, and this suggests that the majority of the rural residents cannot rely on their pensions to ensure their livelihoods. If such a situation continues, rural residents’ enthusiasm for participation will probably decline, which will adversely affect the sustainability of the national pension system. The forecast results further imply that reforms to address the pension adequacy issue may be necessary. Several alternative options include increasing government subsidy or contribution to the NRPS, shifting the voluntary FDC component to a modest mandatory program, improving investment return rate, and exploring other possible support and retirement plans for the retired people.

Scholars, policy makers, and practitioners can benefit from this research because an analytical framework is developed from the perspective of rural residents’ needs and the empirical results also point out the direction of policy improvement. Obviously, this study is limited in the scope, and future research can assess the adequacy of rural pension systems in other regions or countries. Additionally, regional and international comparative studies can also enrich the discussion on pension adequacy.

References

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

Does the New Rural Pension Scheme improve residents’ livelihoods? Empirical evidence from Northwestern China

Does the New Rural Pension Scheme improve residents’ livelihoods? Empirical evidence from Northwestern China